|

The College-goers knew it will hurt:

The wound seems fatal

Soumyabrata Basu

Almost in all the seminars and in articles that made a critical analysis of what the near future will look like begun with “On 8th November 2016…” The date has occupied such a significant place in your memory, if you are a citizen, or in your heart if you are a bhaakt that one need not say it anymore. When amongst all these serious talk shows and opinions from various eminent personalities made the concept of demonetization look like an expert’s task or an expert’s big mistake, which again seemed to require some hardcore economic analysis, the college-goers somewhere felt that an amateur like them can well analyse it. They adhered to what is called the Complete Keynesian Model.

Without going into a deeper economic analysis it is better to know what the students predicted would happen using the said model. With less cash in hand the consumption would fall. As consumption falls at a given income the forceful increase in savings is what they called Paradox of Thrift in strong form. Investment being a function of output would fall as well. The investors would become pessimistic about the economy and sell off their holdings thus causing capital outflow and exchange rate depreciation which would cause price of imported intermediate inputs to rise. Thus, with less inputs to work with the Marginal Productivity of Labourers would fall This fall in labour productivity may increase output but not that much so as to surpass the initial output. Ultimately what we have is a fall in production. The Aggregate Supply falls and so does the Aggregate demand, the intersection of these two predicts a fall in output and a rise in price level, a situation called Stagflation.

So did the students predict it right? Let us now take a look at the scenario post 2016.

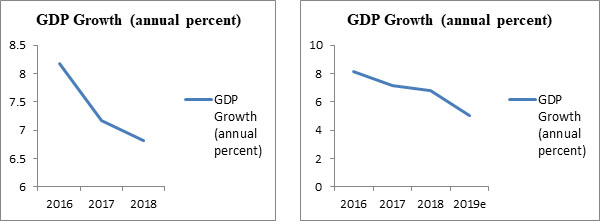

GDP Growth Rate

The world bank data clearly suggests that there has been a sharp decline in GDP from 2016 to 2018.The World Bank’s Report “Global Economic Prospects” of January 2020 states that ‘Growth in India is projected to decelerate to 5 percent in FY2019/20 amid enduring financial sector issues.’

Fig.1 Data Source: World Bank

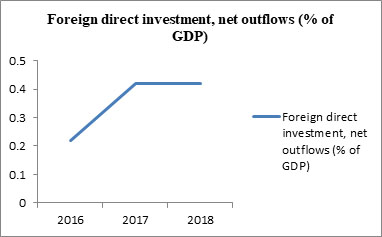

Capital Outflows

The capital outflows increased from 5.047 billion in 2016 to 11.418 billion in 2018 which clearly indicates investors’ pessimism regarding the economy.

Fig.2 Data Source: World Bank

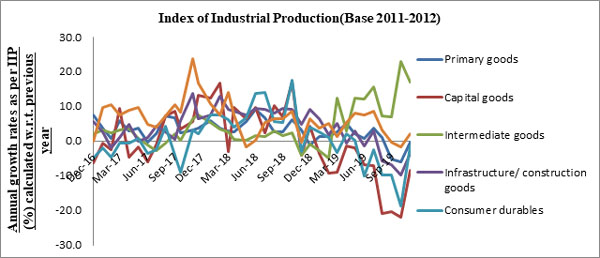

Index of Industrial Production

The November 2019 Business Today article states that ‘India's Index of Industrial Production (IIP) has declined from 5.6 per cent YoY in June 2014 to 2.95 per cent in June 2019 quarter…Since demonetisation, IIP has dropped by 1.54 per cent from 4.49 per cent in September 2016 to 2.95 per cent in the June quarter.’ The performance of the Intermediate goods was the highest in the series. Experts are of the opinion that it is fragnances and oil essentials that has contributed to this growth and the sharp jump is something unexpected. The continuous contraction of the output of capital goods which acts as an indicator of investments suggest that the economy has failed to create enough demand.

Fig.3 Data Source: Data Source: MOSPI

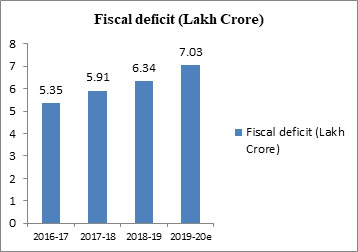

Fiscal deficit

India’s fiscal deficit figures has been rising since 2014 but the recent predictions states that it will cross the 7 lakh crore mark as well. Corporate tax cuts and sluggish economic growth has been held responsible for this situation.

Fig.3 Data Source: Business Today

From the above analysis it is clear that the prediction of the students were not wrong. Amateur students knew it will hurt. Adding salt to the injury were GST and other socio-economic changes and now the wound seems fatal. IMF has recently held India responsible for the sluggish growth. The report states, ‘…The downward revision primarily reflects negative surprises to economic activity in a few emerging market economies, notably India, which led to a reassessment of growth prospects over the next two years.’ The retail prices reached 6 year high figures of around 7.35% in December 2019.Combined with falling economic growth the increase in price level has spread the fear of stagflation among experts. It is surprising that what students or people with minimal knowledge of economics could apprehend, the state could not.

Acknowledgement:

Smt. Moumita Basu, Assistant Professor of Economics, West Bengal Educational Services.

Soumyabrata Basu, St. Xavier’s University, Kolkata

Back to Home Page

Aug 16, 2020

Soumyabrata Basu mailsoumyabrata.eco@gmail.com

Your Comment if any

|